EFFECTIVE DATE: June 1, 2024

Under Section 204 (of Title II, Division BB) of the Consolidated Appropriations Act, 2021 (CAA), insurance companies and employer-based health plans offering group or individual health coverage and self-funded or Administrative Services Only (ASO) group health plans are required to report information about prescription drugs and health care spending to the Departments of Health and Human Services, Labor, and Treasury (Tri-Agencies). This data submission is called the RxDC report. The Rx stands for prescription drug and the DC stands for data collection. This report is due to CMS by June 1, 2024 for the 2023 reference year. CMS has allowed the insurance carriers to file these reports on behalf of employers. However, some of the data required in the report is data that the insurance companies do not have. The carriers are in the process of sending out “surveys” to our clients asking them to complete and send them back to the carriers. With the completed data, insurers submit all of the requested data to CMS by the June 1st due date.

Overview

Under the Consolidated Appropriations Act, 2021 (CAA), health issuers offering group or individual health coverage and self-funded group health plans must submit detailed data on prescription drug pricing and healthcare spending.

This report titled “The RxDC Report” is due June 1st each year. The reporting requirements include information intended to identify the significant drivers of increases in prescription drug and healthcare costs, increase understanding of how prescription drug rebates impact premiums and out-of-pocket costs, and improve prescription drug pricing transparency.

In the original version of this legislation, employers were required to report this data to CMS. In the most recent FAQs, the agency simplified the requirements for employers by allowing most of this data to be reported in aggregate by the individual plan or insurer. This was designed to alleviate some of the challenges an employer might face in gathering this data.

Periods to be Reported

The reporting periods are calendar years and are referred to as “reference years”. The 2023 reference year data is due on June 1, 2024 and on June 1st of each subsequent year. Required entities must submit the report through a web portal managed by the Centers for Medicare & Medicaid Services (CMS), which will collect the data on behalf of the Departments of Health and Human Services, the Department of Labor, and the Department of the Treasury (the “Departments”).

Who Must Report

Insurers are in the process of gathering data from employers for the upcoming June 1, 2024 report filing deadline for reference year 2023. CMS is asking for certain points of data that the carriers do not have and, in order to complete the report, are asking employers to assist with this process by completing electronic surveys or forms. Insurers are in the process of sending out notifications to employers asking them to complete the survey by a specific deadline. These disclosure requirements cover all insured groups with coverage at any time in 2023 including fully insured, level funded and ASO groups.

How is the Reporting Done?

Plans, issuers, and carriers must submit one or more plan lists, eight data files, and a narrative response. Data is reported through the RxDC module in the Health Insurance Oversight System (“HIOS”). An account must be created unless the employer meets the following criteria:

- Already has an HIOS account;

- Is not reporting because a vendor is handling the filing, or;

- The employer is uploading partial data, not including any files.

For all Parrott Benefit Group clients who are either fully or partially (level or balanced funded) insured, the insurance carrier (i.e., BCBSNC, Aetna, UHC) will be handling the filing on your behalf after you have returned the completed survey(s) to the carrier(s).

What You Need to Know

Insurer Survey Questions

Each insurer has created a survey for employers to complete. The layout of each carrier survey may vary but the questions asked within will be similar, if not the same. Much of the data being asked for in the survey is easily accessible and widely known (by the employer) data such as EIN and whether the policy in place is fully insured, self-insured, or level funded. CMS has simplified the requested data and formula for the premium calculation this year. There are now only two specific questions that employers will need to be prepared to answer:

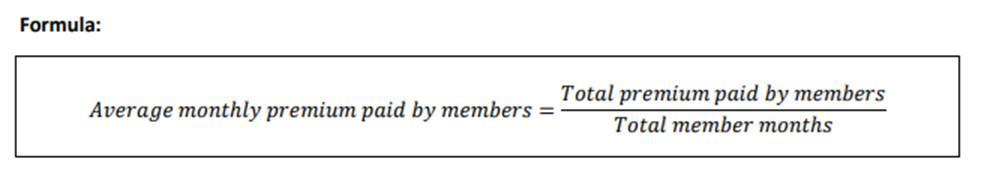

- Average monthly premium paid by members (employees)

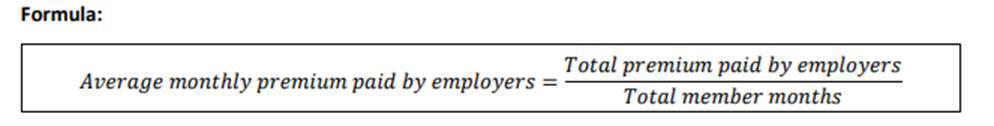

- Average monthly premium paid by employer

CMS has provided specific criteria and a formula for calculating these two numbers. You will find that explanation in the example below.

Calculating Average Monthly Premiums

For the purposes of this report, the term “member” means a person who has health coverage, regardless of whether the coverage is associated with an insurance policy or a group health plan. For example: enrollees, dependents, participants, and beneficiaries are all considered members.

- Total Monthly Premiums Paid by Members/12 months – $60,000

- Total Monthly Premiums Paid by Employers/12 months – $10,000

Average Monthly Premium Paid by Members

Also from CMS is an example of how to calculate the member months:

- Count the number of members covered on a given day of each month of the reference year

- Add the number of members from Step 1 to calculate total member months for the reference year

- To calculate the life years, divide the member months by 12

- Round the resulting number to the 8th decimal place

- Please do not include the following:

- Any part of the premium paid by the employer or other plan sponsors on behalf of the member

Average Monthly Premium Paid by the Employer

For group health plans, employers must report the average monthly premium paid by the employers on behalf of members.

For this calculation employers should include:

- Premiums paid by employers and other plan sponsors on behalf of members (including dependents)

For this calculation they should exclude:

- Any premiums paid by members

Enforcement

If a group does not submit the data requested by the applicable deadline, the carriers will submit to CMS an incomplete record for your company. The group data will not be complete without the required information gathered in the survey and the group will need to submit this data directly to CMS through the HIOS platform no later than June 1, 2024 to avoid any potential penalties.

United Healthcare Report Due Date: April 10

The UHC RxDC survey portal was accessible to clients as of February 21st. They sent a notification to employers asking for you to complete the necessary questions to complete this reporting for the 2023 reference year. To assist in completing the survey, they have asked that you review the worksheet below prior to accessing the link to submit your information.

- Read first: RFI Worksheet

- RxDC Submission: You may access the survey from your UHC Employer Portal

- If you have UHC/UMR or UHC/Surest (not common), use the below RFI Worksheets:

Blue Cross Blue Shield Report Due Date: March 17

On March 15, Blue Cross NC sent an electronic survey to the group contact of record for groups with coverage at any time in 2023 (fully insured and self-funded/ASO groups). This survey will come from the email alias and email address: “Blue Cross NC CAA Prescription Drug Data Request <BlueCrossNC@feedback.bcbsnc.com>.”

- Read first: RxDC Reference Guide

- RxDC Submission: Instructions & Information

- Access the survey HERE

Aetna Report Due Date: April 12

Starting on March 15th, Aetna emailed all clients with the survey link and instructions on how to complete the RxDC report. Please check your inbox for this email and the link to the requested report.

- To learn more about the reporting requirements, refer to the RxDC Reporting Instructions.

Cigna Report Due Date: TBA

- Read first: RxDC Fact Sheet