ACA Affordability: Percentage Decreased for 2022

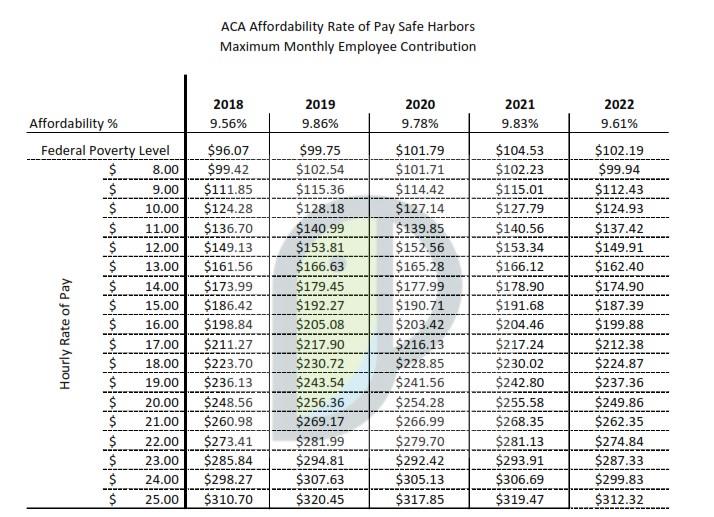

The ACA considers the affordability of employer-sponsored health plans for the purposes of the shared responsibility rules and the premium tax credit (PTC). Affordability depends on a certain percentage of the employee’s household income for the tax year, which is typically adjusted annually for inflation. The IRS released updated guidance recently decreasing the affordability percentage from 9.83% to 9.61% in 2022.

Beginning January 1, 2022, employer-sponsored coverage will be considered affordable if the employee’s required contribution for self-only coverage under the most affordable (lowest cost) medical plan does not exceed 9.61% of an employee’s household income for the year. No matter what type of coverage an employee actually elects, the single premium rate is always the basis for calculating affordability.

In North Carolina, the median household income is $54,602. This means that any employer-sponsored plan that cost-shares a monthly premium, the premium the employee is required to pay cannot exceed $437.27/mo. ($54,602*9.61% = $5,247 / 12 (mo) = $437.27)

Employers not offering affordable, minimum value health coverage to full-time employees will be subject to the employer mandate penalty. Because the percentage is decreasing, employers may have to increase their employer contribution in order for their employee benefits to remain affordable.

It is also important for employers to keep in mind that the ACA Marketplace also considers affordability when determining an employee’s eligibility for a premium tax credit. If an ALE’s full-time employee purchases exchange-based individual coverage and receives a PTC because the lowest cost employee only monthly contribution exceeds 9.61% of their household income for the 2022 plan year, that credit will trigger a shared responsibility penalty for the employer.

ACA Affordability: Marketplace Subsidies

The March 2021 COVID-19 relief legislation, the American Rescue Plan Act (ARPA), extends

eligibility for ACA health insurance subsidies to people buying their own health coverage on the

Marketplace. ARPA expands access to Marketplace subsidies by eliminating the 400% poverty

level income cap. Premiums are now capped, regardless of income at 8.5% of an individuals

modified adjusted gross income (MAGI, for most people this is the same as adjusted gross

income on an individual’s tax return). If a plan’s premium is more than 8.5% of an individual’s

MAGI, a subsidy will cover the difference. For reference, 400% of the poverty level for a single

individual is $51,040 for 2021.

The new law also increases the value of the subsidies for those making between 100% and 400% of the federal poverty level. While those individuals would have previously been eligible for subsidies prior to ARPA, under this law the subsidies are more generous.

The changes are retroactive to January 1, 2021 and in effect for both 2021 and 2022.

Federal Poverty Levels

2021 Federal Poverty Levels (FPL) income numbers below are used to calculate eligibility for Marketplace insurance plans in 2021/2022.

- $12,880 for individuals

- $17,420 for a family of 2

- $21,960 for a family of 3

- $26,500 for a family of 4

- $31,040 for a family of 5

- $35,580 for a family of 6

- $40,120 for a family of 7

- $44,660 for a family of 8

The new law will also make subsidies more valuable to people who have received unemployment compensation in the past year by taking that money out of their income calculations when it comes to determining the value of their subsidy. People whose family income for 2020 exceeded 400% of the poverty level will not need to pay back any excess tax credit monies.